Calling all finance people: Take permission to be extraordinary!

Leadership Blog | 3 minute read

Written by Mike Straw

There is often a contribution people want to make, that for whatever reason, they don’t!

As we work our way around lots of organisations, we hear several conversations happening everywhere. Talk of flexibility, agility and speed in decision making. Artificial intelligence and how to thrive in a digital age. Winning with consumers, M&A activity, ‘doing more with less’, the list goes on… It is not that these sentiments and calls to action are wrong, but how do you turn them from words into actions? And more specifically, how can the finance folks really make an impact by helping their organisations to thrive in this climate? To be the business leaders they could be.Finance have a big role to play in enabling and leading organisations to capitalise on the above. But all too often the role they play falls way short of their potential.

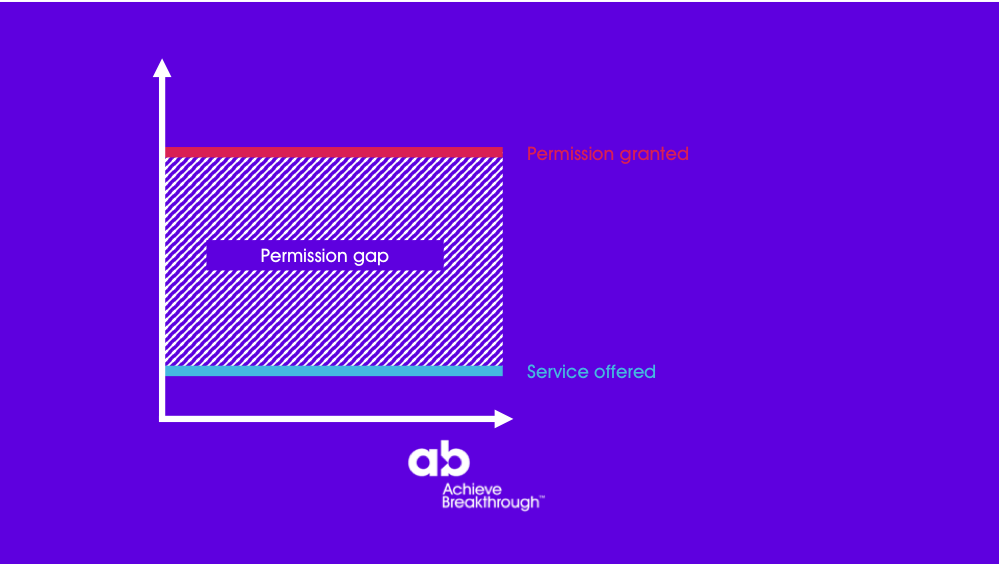

Falling short - mind the permission gap

Take this situation I experienced recently. My bank manager (yes, they still exist apparently) came to me for the first time in 15 years to talk about what my account could offer me and all things financial. Given I have banked with them for over 30 years I asked him what information he had about me; my spending habits, household outgoings, mortgages and such like. His response was very disappointing; he had no insight apart from my current bank balance and an offer to find out more. Given our bank accounts give huge insight into how we spend our money and live our lives, any finance manager could add real value to us re: products and services they offer and suggested ways we could optimise our money. But instead, they perform a transactional service, well below the permission levels we give them.

State of the function

I see this same dynamic in most organisations, where the finance people have:

- Access to the detailed financial information in the organisation

- Access to the strategy and how it could be enabled financially, and what we would need to get right to succeed

- Different options that could support the business in its risk taking and control

- Access to giving predictive analytics, scenario planning

What we see is a control and caution orientated department with a leaning to looking back. With service or offers below the permission levels that finance people could take. We all know how refreshing it is when you get some great analysis and insight that allows you to make bold decisions and see a new pathway to delivering the strategy.

Bigger permission

My call to all finance people is to challenge the permission you’re taking and the offers you make. And be bold! Push the boundaries and develop your capabilities to surprise and delight the people you partner and work alongside. The shift is simple; to being business leaders who drive the strategy versus respond to it. In short, to be business leaders first, with finance expertise.

The place to start is creating strong partnerships at all levels. To find out where you are, ask these 4 questions:

- Do you have a seat at the table because a) you’re valuable or b) they’re polite?

- Are you adding value to the strategic direction?

- Are you called by the strategic team for advice?

- Is your contribution asked for, outside of the finance arena?

Lastly ... if the answer isn’t yes from question 2 through to 4, then the answer to question 1 is ‘they’re being polite’! Politeness is code for; ‘you are not exciting them by what you can offer’.

Upping your contribution

If you had no limits:

- What breakthrough contribution would you make to your partners?

- What capability do you need to make these offers?

Now, go make those offers and get those capabilities!!

Published 28/09/2018

Subscribe by Email

Achieve more breakthroughs. Get expert leadership ideas, insights and advice straight to your inbox every Saturday, as well as the occasional bit of news on us, such as offers and invitations to participate in things like events, webinars and surveys. Read. Lead. Breakthrough.

Related posts

Leadership Blog

Why organisational agility starts with mindset, not operating models

Achieve Breakthrough | 17/02/2026

Leadership Blog

Curiosity as culture: The social glue of high-performing teams

Achieve Breakthrough | 10/02/2026

Leadership Blog

Why better questions build better teams: The cultural case for curiosity

Achieve Breakthrough | 03/02/2026

Leadership Blog

Leading with the handbrake off: Why curiosity is a strategic operating system for uncertainty

Achieve Breakthrough | 27/01/2026